Here are some thoughts about the current cattle market from Dr. James Mitchell.

Why is This Time Different?

By: James Mitchell, University of Arkansas

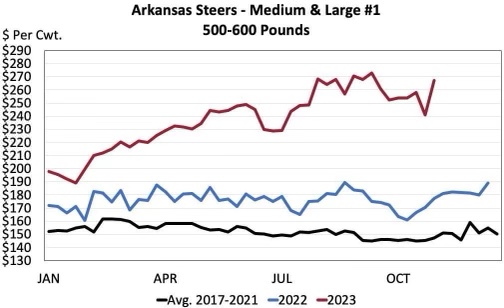

A lot has been said about tight cattle supplies in 2023. The January 2023 Cattle Inventory report estimated total cattle supplies at 89.27 million head, down 3 percent year over year but still 1 percent above the previous low in 2014. The result of tight cattle supplies across all sectors of the beef cattle industry has been historically high prices. Through October, prices for a 400-500-pound steer calf in Arkansas average $269 per hundredweight. This is more than $90 per hundredweight higher than in October 2022 when prices averaged $177 per hundredweight. Prices are high across weight classes in Arkansas. In October, 500-600-pound stocker cattle prices averaged $252 per hundredweight, and 700-800-pound feeder cattle prices averaged $220 per hundredweight, 52 percent and 47 percent higher year over year, respectively.

It is hard not to compare the current situation to 2014, when total cattle inventories were 88.24 million head. Cattle prices in 2014 set records. However, many of us are also keenly aware of 2015 and 2016. Herd expansion occurred rapidly. By January 2016, total cattle inventories were 4 percent higher than in January 2014. In Arkansas, what followed were cattle prices that declined 33% by 2016. The prospect of a scenario similar to 2015-2016 has many equally worried. Those concerns are valid, but most analysts agree that there are some fundamental differences between today and the last time we saw high cattle prices. Two of those differences are worth mentioning.

The most obvious, and perhaps the most important, difference between today and 2014-2015 is drought. The drought map at the end of this newsletter shows 37 percent of cattle inventory in a drought-impacted region. Four weeks ago, 47 percent of cattle inventory was in drought. At the end of October 2015, only 20 percent of cattle inventory was in a drought-impacted region. Herd expansion will not occur until we have grass.

The second difference between today and 2014-2015 is higher prices have yet to translate to higher profits for cow-calf producers—at least profits high enough to signal expansion at a national level. The Livestock Marketing Information Center (LMIC) estimates 2023 cash costs at $1,088 per cow, which implies a breakeven price of $218 per hundredweight for a 500-pound steer. In 2014, cow costs were $879, resulting in a breakeven price of $176 per hundredweight. Enterprise budgets and cattle markets in 2023 are projecting a profit for cow-calf producers. However, relative profitability still needs to improve before seeing herd expansion on a noticeable scale.

While there may be a tendency to compare the current situation to 2014-2015, a lot is different this time, which leads to a more positive outlook over the next couple of years. Some of these differences are driven by weather and agricultural markets. Drought is still a present threat, and costs are still a problem. Other differences are due to a cattle industry that has undergone significant structural change since 2014. Perhaps most importantly, profitability has yet to improve to a point that would signal rapid herd expansion.